Why You Should Discuss an Offshore Trust With Your Estate Lawyer

Why You Should Discuss an Offshore Trust With Your Estate Lawyer

Blog Article

How an Offshore Depend On Can Enhance Your Financial Personal Privacy and Safety And Security

Offshore counts on offer a strategic approach to financial privacy and security. By putting assets past the reach of residential lawful cases and lenders, people can establish a prepared financial environment. These counts on are commonly established up in territories with rigorous personal privacy laws, guaranteeing that delicate information remains protected. Nonetheless, the complexities surrounding overseas counts on increase essential questions regarding their application and advantages. What does it require to maximize their benefits?

Recognizing Offshore Trusts: A Brief Review

Offshore trusts have gained substantial interest as a calculated tool for asset security and economic privacy. These lawful entities are developed in territories outside an individual's home nation, supplying a framework for handling and securing possessions. By transferring possession of properties right into an offshore depend on, people can divide their personal wealth from potential legal claims or creditors, boosting security.Typically, offshore trust funds are utilized to hold different properties, including actual estate, investments, and cash. They typically entail a trustee, who takes care of the count on according to the terms established by the grantor. This arrangement can supply benefits such as lowered taxation and higher control over property circulation, depending on the territory's laws.Investors and high-net-worth people commonly look for offshore depend diversify their financial techniques while maintaining discretion. Overall, overseas counts on work as a sophisticated option for those looking for to secure their wide range and assurance long-lasting monetary security.

The Relevance of Financial Personal privacy in Today's Globe

In today's digital age, the erosion of personal privacy poses considerable difficulties for individuals looking for to shield their monetary information. With rising cybersecurity risks, the demand for effective legal security mechanisms ends up being significantly crucial. Recognizing the relevance of financial personal privacy is crucial for protecting possessions and guaranteeing long-term safety.

Disintegration of Personal Personal Privacy

As the electronic age progresses, the disintegration of individual privacy has become progressively noticable, influencing people' economic security. With the expansion of social media and on the internet purchases, personal information is extra available than ever before, bring about an increased danger of unapproved gain access to and abuse. Individuals typically unconsciously share delicate data, which can be made use of by different entities, including federal governments and corporations. This diminishing personal privacy landscape has elevated issues regarding the safeguarding of economic properties, as traditional steps may no longer suffice. Subsequently, individuals seek alternatives to protect their financial details, motivating an expanding rate of interest in overseas depends on. These entities provide a method to improve personal privacy and safe individual wealth against the susceptabilities of an interconnected globe, highlighting the vital need for durable financial personal privacy services.

Increasing Cybersecurity Risks

Increasing cybersecurity risks pose substantial challenges to economic privacy in today's interconnected world. As technology developments, so do the tactics employed by cybercriminals, targeting delicate financial details with boosting class. Information breaches and identification theft cases get on the increase, leaving people susceptible and questioning the security of their financial and individual data. In addition, the growing dependence on digital transactions improves the risk of exposure, as hackers manipulate weaknesses in on-line systems. This worrying fad highlights the need for boosted financial privacy actions, as traditional safeguards may no longer suffice. People and organizations alike should focus on shielding their financial information, taking into consideration offshore depends on as a viable choice to maintain and alleviate threats confidentiality in an age of rising cybersecurity dangers.

Legal Defense Mechanisms

The rising hazards to financial privacy emphasize the need for robust legal security systems. In today's intricate monetary landscape, individuals seek safeguards against unauthorized accessibility and prospective exploitation of their economic details. Lawful structures such as overseas trusts offer necessary layers of discretion and property defense. These depends on typically run under jurisdictions with strict personal privacy legislations, enabling individuals to protect their possessions from spying eyes. In addition, lawful securities can prevent unwarranted insurance claims and supply a protected atmosphere for wide range management. By leveraging these systems, individuals can improve their financial safety while preserving a degree of privacy that is significantly hard to attain in the electronic age. Inevitably, reliable lawful securities are vital for protecting financial autonomy and safety and security.

Territories With Strong Privacy Legislation

While numerous territories provide varying degrees of financial personal privacy, a choose few attract attention because of their durable legal frameworks created to secure the privacy of assets. Nations like Switzerland and the Cayman Islands are renowned for their rigid privacy legislations, allowing individuals to keep a high level of privacy worrying their economic transactions. In Switzerland, banking privacy laws offer a strong shield versus the disclosure of account details, while the Cayman Islands uses flexible count on frameworks that boost confidentiality.Other noteworthy territories include Belize and Nevis, which have actually enacted regulations to safeguard the personal privacy of depend on recipients and asset owners. These areas stress the significance of discernment, drawing in those looking for to safeguard their financial details. By establishing counts on in such territories, people can successfully improve their financial personal privacy while taking advantage of legal defenses that prevent unwanted examination from outdoors entities.

How Offshore Depends On Secure Your Possessions

Offshore trusts provide a robust framework for protecting possessions via lawful methods, securing them from creditors and possible legal actions. They also offer boosted privacy and privacy, making certain that individual find out here financial info stays protected. In addition, these trust funds can incorporate tax obligation effectiveness techniques that optimize financial benefits while following applicable laws.

Legal Property Defense

Using offshore depends on can substantially improve legal asset protection for individuals seeking to secure their wealth from legal claims and prospective lenders. Offshore depends on, established in territories with favorable asset protection regulations, can secure possessions from litigation threats. When possessions are held in an overseas count on, they are legally possessed by the trust fund itself, making it tough for financial institutions to access them straight. This splitting up between personal and trust properties can discourage legal obstacles and provide a robust barrier against cases. In addition, many overseas jurisdictions have strong privacy laws that prevent information disclosure, more enhancing the security of the assets held in depend on. Because of this, offshore trust funds act as a calculated tool for securing wealth and making sure lasting economic security.

Privacy and Confidentiality

The personal privacy and privacy provided by offshore trust funds are significant benefits for people looking for to protect their possessions. These trusts give a layer of privacy, making it testing for creditors, plaintiffs, or possible plaintiffs to trace ownership of possessions. By placing assets in an offshore depend on, individuals can guard their economic details from public analysis and decrease the danger of identity theft. In enhancement, lots of overseas jurisdictions have stringent privacy legislations, making sure that the details of the count on and its recipients stay exclusive. This level of discretion not just helps shield individual information however likewise preserves wealth from outside threats. On the whole, the improved personal privacy managed by overseas counts on is an engaging factor for people to review them as a calculated property defense tool.

Tax Effectiveness Techniques

By developing an overseas trust fund, people can execute effective tax obligation performance methods that secure their possessions while possibly minimizing their tax obligations. Offshore depends on typically give distinct tax advantages, consisting of the capacity to postpone taxes on earnings created within the depend on. In lots of jurisdictions, these trusts can additionally minimize estate taxes, as properties kept in the depend on may not undergo regional inheritance laws. In addition, offshore trust funds can facilitate the critical allotment of earnings among recipients, allowing for enhanced tax obligation prices. This framework can ultimately result in considerable tax obligation savings, making it an enticing choice for high-net-worth people. By leveraging these advantages, individuals can enhance their monetary personal privacy while preserving conformity with worldwide tax guidelines.

Lawful Protections and Advantages of Offshore Trusts

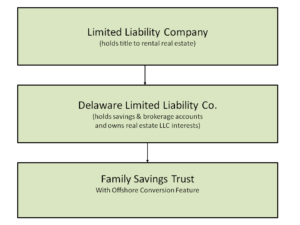

While several people look for financial personal privacy and protection, offshore depends on use an array of legal defenses and advantages that can significantly boost property administration. These trusts are regulated by the legislations of the territory in which they are developed, frequently supplying durable lawful frameworks that protect assets from prospective residential lawful challenges.One vital advantage is the ability to different individual possessions from organization interests, thus minimizing exposure to obligation. In addition, overseas trust funds can promote estate preparation by permitting smoother transfers of wealth throughout generations while minimizing probate costs.The flexibility in depend on frameworks makes it more info here possible for tailored remedies to meet specific economic objectives, and the privacy related to offshore territories can additionally secure sensitive monetary information. Overall, the legal securities and advantages of overseas trust funds make them an engaging choice for people aiming to secure their economic future while preserving personal privacy.

Enhancing Security Against Legal Dangers and Creditors

Actions to Establishing an Offshore Trust Fund

Developing an offshore trust fund needs a collection of systematic steps to assure conformity with legal policies and to optimize the intended advantages. A private need to pick a trustworthy jurisdiction that lines up with their purposes, taking into consideration elements like tax obligation effects and regulatory framework. Next off, it is important to engage a professional legal expert who focuses on overseas depend navigate complicated laws.Following this, the individual should specify the trust fund's structure, determining beneficiaries and trustees, and drafting the trust fund act, which details the conditions of the trust.Afterward, moneying the trust fund is essential; possessions can include cash money, actual estate, or financial investments. Continuous monitoring is necessary to maintain compliance and adapt to adjustments in regulations or individual situations. By carefully following these actions, individuals can successfully establish an offshore count on that boosts their monetary personal privacy and protection.

Regularly Asked Questions

What Are the Expenses Related To Establishing up an Offshore Depend on?

Establishing an offshore trust fund sustains different prices, including legal charges, configuration charges, annual upkeep fees, and possible tax obligation effects. These costs can differ substantially based upon jurisdiction, complexity, and the services needed for administration.

Can I Handle My Offshore Trust Myself?

Managing an offshore trust individually is possible; nevertheless, it needs a comprehensive understanding of legal and monetary policies. Many select expert administration to ensure compliance and ideal possession defense, lessening threats connected with self-management.

How Do I Choose the Right Territory for My Trust?

Choosing the right jurisdiction for a trust fund entails assessing factors like lawful security, tax effects, possession protection legislations, and personal privacy laws. Offshore Trust. Complete research and examination with economists are vital to make an informed decision

Are Offshore Trusts Legal in My Country?

Figuring out the validity navigate to this website of overseas counts on differs by country. Individuals ought to seek advice from regional laws and guidelines to ensure conformity, as some jurisdictions may impose limitations or particular demands on developing and preserving such trusts.

What Occurs if I Required to Gain Access To Depend On Funds?

They normally send a demand to the trustee when people need to access trust funds. The trustee evaluates the demand based on the trust's terms, guaranteeing compliance with lawful commitments before paying out any funds. By transferring possession of properties into an offshore trust, people can separate their personal riches from prospective legal cases or creditors, boosting security.Typically, offshore depends on are utilized to hold numerous properties, including genuine estate, financial investments, and cash money. When properties are held in an offshore depend on, they are legally owned by the trust fund itself, making it tough for creditors to access them directly (Offshore Trust). Offshore trusts usually supply unique tax advantages, consisting of the capacity to defer tax obligations on income created within the trust. Furthermore, overseas depends on can promote estate planning by permitting for smoother transfers of riches throughout generations while minimizing probate costs.The flexibility in trust fund structures allows tailored services to satisfy particular monetary objectives, and the confidentiality linked with offshore territories can additionally secure delicate economic details. Next, it is important to engage a competent legal consultant that specializes in overseas counts on to browse complicated laws.Following this, the individual should specify the trust's structure, determining beneficiaries and trustees, and composing the depend on action, which describes the terms and conditions of the trust.Afterward, moneying the depend on is crucial; properties can consist of cash money, actual estate, or financial investments

Report this page